Are you competitive? How are you creating your competitive edge? Would you say that you are the leader of the pack? Beating out your competition? When was the last time you thought about it?

Are you competitive? How are you creating your competitive edge? Would you say that you are the leader of the pack? Beating out your competition? When was the last time you thought about it?

One of my favorite types of professionals to work with is the financial advisor. Why? They understand that in order to take their production to the next level they must invest in themselves and their business. The investment is a combination of hiring associates to delegate to and free up time to find and help more people, hiring a personal trainer to stay physically fit and have a higher degree of self-confidence, and hiring professional consultants, i.e. life coaches, LinkedIn trainers, etc., who can help them tap into opportunities they may be missing and equip them to navigate new opportunities. Financial representatives are highly motivated and are driven to excel in all endeavors they pursue…the successful ones anyway.

Disclaimer: Do the above attributes apply to you even though you’re not a financial advisor? We think that is fantastic. We know there are a ton of professionals out there who live out those characteristics every day, and who are pretty darn successful in their careers too. This blog post is for you also.

I have had the pleasure of partnering with a Fortune 100 financial institution for the past fourteen months. If you’re in the financial industry, heck any industry (yes, you name it and we’ve probably worked with that industry), and you’re contemplating joining LinkedIn, here is my pitch to you on the top three reasons why you should consider using it as an additional tool in your business belt:

Reason #1: People are looking for you…scratch that. People are looking to hire you as their next financial advisor.

Guess what? Whether you want to believe it or not, people are vetting you before they decide to engage with you. Have you sent an email to a potential client and not received a response? Have you left a potential client a voice message and not received a call back? There is a very high likelihood that the individual is doing their homework before they decide to engage with you. In fact, people are 60% along in their decision-making process before they decide to engage with a salesperson. LinkedIn says, “…close to 90% of people with assets between $100K – $1M turn to social media to help them make important financial decisions.”

These potential business opportunities are calling their friends to vet you and they are looking online to vet you. So, you don’t think they have a LinkedIn account? Doesn’t matter. Why? LinkedIn and Google love each other. That’s right. People do not have to have a LinkedIn account to see your public profile. Are you on LinkedIn? Have you Googled your name recently? Go ahead and try it. If you’re on LinkedIn, I bet one of the top search results that comes up will be your LinkedIn profile.

You see, it is our responsibility to make sure that we are representing ourselves accurately and completely when people find us online. And hey, all we’re going for is to look reasonably intelligent.

Building your LinkedIn profile is a critical component to your success. Not just your success on LinkedIn; your success, period. There are more than two people joining the LinkedIn global network every second. These individuals account for more than 187 million unique visits to LinkedIn each month.

If you are building your LinkedIn profile the right way, it should take upwards of eight hours. That is quite a bit of time to devote and often people are not sure where to get started. Also remember these three important rules when developing your LinkedIn profile:

- There is no draft version of your LinkedIn profile

- There is no spellcheck

- There is no formatting

We have published many posts on the topic of the LinkedIn Profile, but if you want more direct assistance with the topic, let us know.

We have built dozens and dozens of professional LinkedIn profiles to help elevate you to the next level. Don’t you want to make sure that the reputation you have offline in your business community is mirrored online when people find you?

Reason #2: Your competitors are using LinkedIn to find more clients.

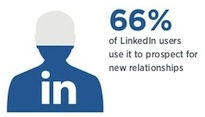

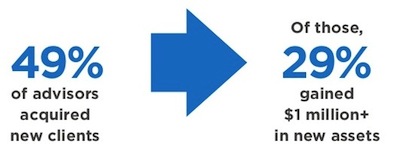

While there are still some financial institutions that do not allow their advisors to use LinkedIn, most companies now allow it. What is the most interesting part about companies who must be FINRA and SEC compliant is that each company interprets the regulations differently. Most companies have an internal social media policy. Some companies use third parties, like Hearsay Social, to help manage their online presence. Whatever your company’s regulations may or may not be, here are a few statistics to ponder in the financial services industry:

Those stats get me excited. What an opportunity you have! Even if you want to fight the numbers, let’s turn it around: If you thought that your competitors were not using LinkedIn, wouldn’t you want to be where they aren’t? I think so. Capitalize on their lack of knowledge to tap into an abundance of potential conversations.

So, let’s revisit: LinkedIn provides great opportunities! If you want to be ahead of the game, don’t wait because your competitors are bound to catch up, if they aren’t already at the game.

You are not using LinkedIn to sell for you. You are using LinkedIn as an entry point for conversations. In six weeks I generated 38 in-person meetings that were initiated on LinkedIn. How did I average almost 7 new meetings each week? I was proactive with what was sitting in my LinkedIn account (i.e. pending invitations, messages, profile views, etc.). Instead of just expecting meetings to fall from the sky, I actually asked to talk with people before just accepting them into my network.

Reason #3: You can manage more relationships…a.k.a. create more opportunities.

Understand who is in your network. Take your offline network and bring them online.

I don’t know about you, but my brain can only juggle so many relationships at one time. I use LinkedIn as my database. When you are able to understand who is in your network, you can then begin to understand how to tap into it.

I don’t believe in making cold calls. Yes, you read that correctly. If you are an exceptional professional who people love to hire for your expertise, and if you are authentically building your network with strong ties, you should be able to ask for introductions. Introductions change your would-be-cold calls into warm calls. You have to identify centers of influence in your network that will be likely to create introductions for you.

Isn’t it nice to know when people are thinking about you? LinkedIn gives you the insight you need to stay top of mind with your connections. From birthdays to job promotions, sending a quick note can go a long way. Why would you use LinkedIn over email? LinkedIn messages have an 85% open rate over basic email.

When you use LinkedIn to meet more people and stay top of mind you have a great chance of filling your calendar with calls and meetings faster than you can keep up.

Let’s recap these three reasons why financial advisors should use LinkedIn:

Reason #1: People are looking for you…scratch that. People are looking to hire you as their next financial advisor.

LinkedIn even writes about how individuals can use LinkedIn to find a financial advisor.

Reason #2: Your competitors are using LinkedIn to find more clients.

You are not exempt. If you are not connecting with your clients and prospects, you better believe that your competition is gunning for them.

Reason #3: You can manage more relationships…a.k.a. create more opportunities.

Bring your offline relationships online so you can get introduced to more potential clients. Chances are, your network is significantly bigger than you think.

What are other ways you are using LinkedIn to drum up more conversations and build more relationships?

References: